IN A WORLD THAT’S CHANGING SO QUICKLY THE BIGGEST RISK YOU CAN TAKE IS NOT TAKING ANY RISK. Peter Thiel

Pope Francis Dies

AI startup to automate the entire workforce

UAE plans to let AI write the laws

Global Growth Slowdown

Tariff Tone Softens

Market view by Benjamin Cowen

Science & Technology

Pope Francis Dies

Pope Francis prays with priests at the end of a limited public audience at the San Damaso courtyard in The Vatican on Sept. 30, 2020.Filippo Monteforte—AFP/Getty Images

Pope Francis died at the age of 88 of a stroke and irreversible heart failure, the Vatican announced yesterday. The argentine-born pontiff had returned to work following a battle with double pneumonia and related health complications in late March after a five-week hospital stay. He made his last public appearance at St. Peter’s Basilica on Easter Sunday, offering a final blessing for the world’s 1.3 billion Catholics.

Born Jorge Mario Bergoglio, he was the first Jesuit pope, the first from the Americas, and the 266th leader of the Catholic Church. His papacy, which began in 2013, was marked by reforms addressing climate change, Vatican finances, a focus on synodality- where all members of the church participate in its mission-and efforts to tackle clerical abuse and promote social justice. Pope Francis lived simply in a small Vatican apartment rather than in the Apostolic Palace.

The church now enters the “sede vacante” period with Irish American Cardinal Kevin Farrell acting as the camerlengo, or acting head of the Vatican until a new pontiff is elected. Cardinals under the age of 80 will convene within 15 to 20 days to elect a new pope through a secret ballot conclave. see the significance of black or white smoke here.

AI startup to automate the entire workforce

Image source: GPT / The macro scratch

Epoch co-founder Tamay Besiroglu just launched Mechanize, a new startup developing virtual environments and training data to enable AI agents that can replace human workers for the “full automation of all work”.

the company plans to create simulations of workplace scenarios to train AI agents in handling complex, long-term tasks currently performed by humans.

Mechanize will initially focus on automating white-collar jobs, with systems that can manage computer tasks, handle interruptions, and coordinate with others.

Backed by tech leaders including Jeff Dean and Nat Friedman, the startup estimates its potential market at $60T globally.

The announcement drew criticism for both the economic implications and potential conflicts with Besiroglu’s role at AI research firm Epoch.

Besiroglu and co. likely aren’t the only researchers that think AI is set to automate every aspect of work — but with tensions already high over both negative views of AI and mounting job losses, this goal might be saying the quiet part a bit too loudly. The age of automation is coming, and not everyone will be happy about it.

UAE plans to let AI write the laws

Image source: GPT-4o / The macro scratch

The United Arab Emirates unveiled plans to become the first nation to integrate AI directly into its lawmaking process, establishing a new government unit to oversee the transformation of how laws are written, reviewed, and updated.

A new Regulatory intelligence Office will lead the initiative ,which aims to cut legislative development time by 70% through AI-assisted drafting and analysis.

The system will use a database combining federal and local laws, court decisions,and government data to suggest legislation and amendments.

The plan builds on the UAE’s major investment in AI, including a dedicated $30B AI-focused infrastructure fund through its MGX investment platform.

The move was met with mixed reactions, with experts warning of the tech’s reliability, bias, and interpretive issues present in training data.

While many governments have already begun integrating AI into their ranks, this is one of the first examples of giving it legislative power in some capacity. As systems reach superhuman levels of persuasion, reasoning, and more, their use in politics will raise existential questions about AI vs. human judgment in lawmaking.

Global Growth Slowdown

The International Monetary Fund lowered its 2025 growth outlook for the US and the global economy, citing heightened uncertainty and economic disruption caused by President Donald Trump’s sweeping new tariffs.

The IMF (see overview) trimmed the 2025 US growth estimate to 1.8% from 2.7%, the largest reduction among the world’s advanced economies, and cut the global growth forecast to 2.8% from 3.3%. The fund cautioned the trade policy climate and ongoing conflicts between the US and tariff-hit countries are discouraging investment and spending. US inflation is now predicted to reach 3% this year, one percentage point higher than IMF’s January projection, while the risk of a US recession has increased to 40%, up from25% in October.

Separately, the White House signaled trade tensions with China could cool, while businesses continued to announce investments in the US, including yogurt maker Chobani, which plans to invest at least $1.2B in New York, and Swiss pharma giant Roche, which aims to invest $50B over the next five years.

Tariff Tone Softens

President Donald Trump expressed that he was willing to substantially reduce tariffs on Chinese goods earlier this week, signaling a shift following recent tension and reciprocal tariff increases between the world’s two biggest economies.

While discussions remain open, an unnamed White House official shared tariffs on Chinese goods are likely to come down to between 50% and 65%. Officials are also considering a tiered approach that phases in different levies over five years.

Chinese officials indicated they were open to trade talks yesterday, though not under continued threats from the US. Earlier this month, the US raised tariffs on Chinese goods to 145%, prompting China to respond with a 125% retaliatory tariff and additional measures.

Trump’s latest remarks come after a Monday meeting with representatives from US retail giants like Walmart and Target. Recent tariff escalations prompted anxieties among industry leaders, investors, and Americans in general while also causing upsets in global markets and raising fears of recession.

Market view by Benjamin Cowen

Bitcoin dominance has reached a new cycle high, surpassing the previous peak from February. This represents Bitcoin’s market share relative to all cryptocurrencies and indicates a flight to relative safety within the crypto market as altcoins continue to devalue against Bitcoin.

The current trend suggests Bitcoin dominance will likely continue rising to around 66%, potentially higher. This prediction is supported by Fibonacci retracement levels, with the 78.6% level positioned around 66%. When excluding stablecoins, Bitcoin dominance is even higher at approximately 69-70%.

Two key factors driving this trend are:

1. Ongoing Quantitative tightening (QT): Historically, Bitcoin dominance tops when QT ends. Despite the Federal Reserve slowing down QT and cutting interest rates by 100 basis points, monetary policy remains restrictive. Last cycle, the Fed cut rates by 75 basis from a terminal rate of 2.5% , whereas this cycle they’ve cut 100 basis points from a terminal rate of 5.5%. Proportionally, this represents a smaller reduction than last cycle.

2. Altcoin Market Cap: The chart for the ratio of altcoin market capitalization to Bitcoin suggests altcoins continue to lose value relative to Bitcoin. Historically, altcoins tend to bottom when they reach approximately 25% of Bitcoin’s market cap.

Other indicators supporting this view include:

Low social risk metrics, suggesting limited retail interest in crypto

The Advance Decline Idesx for top 100 cryptocurrencies continuing to set new lows

Ethereum-to-Bitcoin ratio reaching new lows

The current market phase resembles the period from early 2018 to late 2019 in terms of monetary policy effects. For altcoins to durably outperform Bitcoin, there needs to be increased retail interest and social risk metrics, along with a shift in monetary policy from quantitative tightening to easing.

Bitcoin dominance will likely continue its upward trend until there are significant changes in monetary policy, particularly an end to quantitative tightening, which could potentially happen in the coming months.

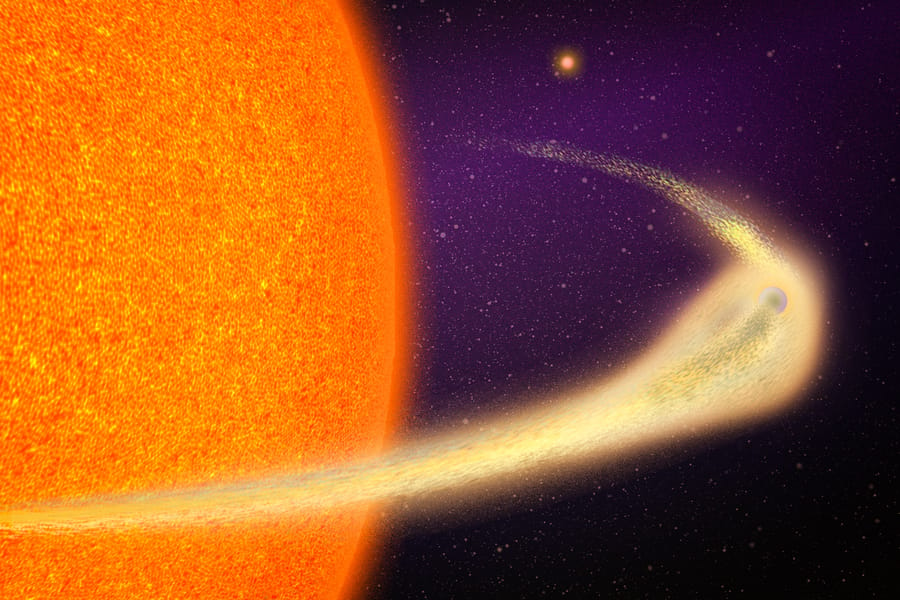

Science & Technology

> Astronomers discover rapidly disintegrating planet, producing a comet-like tail as it orbits; Mercury-sized planet loses amount of material equivalent to Mount Everest roughly every 30 hours (More)

>Scientist “create” a new color by using a laser to stimulate the retina; five people have reported seeing the new color dubbed “olo,” a highly saturated blue-green(More)

The scientists said this shade was the closest to olo, which is much more saturated

>Engineers develop hyper-resilient lithium-ion battery that can be stretched and twisted and continue to power device after being cut in half(More)

Researchers integrated a battery and circuit into a self-healable electronic system capable of recovering from being cut through by a razor blade.Peisheng He, Jong Ha Park, et al. Peisheng He, Jong Ha Park, et al.

Podcast of the week:

https://www.youtube.com/watch?v=KyfUysrNaco&t=2125s