IN A WORLD THAT’S CHANGING SO QUICKLY THE BIGGEST RISK YOU CAN TAKE IS NOT TAKING ANY RISK. Peter Thiel

Table of Contents

THE MACRO

Waltz Shuffles Out

National Security Adviser Mike Waltz was relived of his current role and will become ambassador to the United Nations, according to a social media post by President Donald Trump. The decision comes after fallout from a leak of military plans in a Signal group chat. Secretary of state Marco Rubio will fill the role on an interim basis.

Waltz is the first senior leader in Trump’s second administration to exit his role. As national security adviser, Waltz was tasked with providing the president with direct, cross-departmental reports on national security and producing the president’s daily brief. The White House had reportedly considered firing Waltz for weeks due to his role in the leak, in which the three-term former Florida congressman unintentionally invited Atlantic editor Jeffrey Goldberg into a group chat discussing imminent military plans in March.

Tariff Loophole Expires

The US ended a “de minimis” tariff exemption for packages from China and Hong Kong yesterday, which allowed duty-free entry for shipments of goods valued under $800. The so-called loophole was widely used by overseas online retailers, like Shein and Temu, to offer cheap products directly to American consumers.

The de minimis exemption has existed since 1938 (see history), with its threshold adjusted periodically over time. The most recent change came in 2016, when the limit was raised from $200 to $800, allowing more packages to qualify for the perk. With the exemption now gone, low-value packages from China and Hong Kong are subject to new tariffs, some as high as 145%. Price on many imported goods are expected to rise, with retailers adding tariff surcharges or shifting their business models. Temu announced it has stopped shipping products from China and will only display products shipped from its US warehouses.

US Customs also faces the potential challenge of inspecting millions more packages, which could cause shipping delays. Roughly 1.36 billion shipments using the de minimis provision entered the US in fiscal year 2024, per federal data.

White House proposes cutting $163B in federal budget

The proposal would cut federal spending from nondefense discretionary programs, including those related to the environment, renewable energy, education, and foreign aid, by 22.6% to the lowest level since 2017. In contrast , the proposal would increase military spending by 13% to over $1T and funding for Homeland Security by nearly 65% to $175B. The plan outlines the administration’s fiscal priorities and will undergo debate in Congress before any measures are enacted. See details of the proposal here.

Ireland fines TikTok $600M for sending EU user data to China

The fine comes after a four-year investigation found the video-sharing platform’s transfers of user data to China violated EU data privacy laws and lacked sufficient transparency. Ireland’s data watchdog—the EU’s lead regulator for TikTok—ordered the company to fix the issues within six months. TikTok plans to appeal, arguing recent security improvements were overlooked.

Science & Technology

Study questions leading AI benchmark

A new study from researchers at Chore Labs, MIT, Stanford, and other institutions claims that LMArena, the leading crowdsourced AI benchmark, gives unfair advantages to major tech companies, potentially distorting its widely-followed rankings.

The study claims providers like Meta, Google, and OpenAI privately test multiple model variants on the Arena to publish the best performers.

It also found that models from top labs were favored over small/open models in sampling, with Google and OpenAI receiving over 60% of all interactions.

Experiments showed that access to Arena data boosts performance on Arena-specific tasks, suggesting model overfitting rather than actual capability gains.

The researchers also noted that 205 models have been silently removed on the platform, with open-source models deprecated at a higher rate.

LMArena has disputed the study, claiming the leaderboard reflects genuine user preferences. However, these claims can damage the platform’s credibility, which shapes how models are perceived. Combined with the Lama 4 Maverick benchmark debacle, this study highlights that AI evaluation isn’t always as it seems.

GPT-4o’s new personality problem

OpenAI is working to fix an unexpected issue with its newly updated GPT-4o after users and tech leaders called out the AI’s excessive flattery and tendency to agree with everything users say, even potentially harmful ideas.

OpenAI released the updated 4o last week, promising better memory saving, problem solving, and personality and intelligence improvements.

Users began noticing the update made GPT-4o excessively complimentary and agreeable, sometimes validating questionable or even false statements.

Sam Altman posted that 4o became “annoying“ and “syncophant-y,“ noting the need to eventually have multiple personality options within each model.

OpenAI has already deployed an initial fix to reduce the AI’s “glazing” behavior, with updates planned throughout the week to find the right balance.

Industry veterans warn the issue estends beyond ChatGPT, suggesting it’s broader challenge facing AI assistant designed to maximize user satisfaction.

This personality”upgrade” is revealing a major issue — the difficulty of balancing having positive, longer interactions with being truthful and responsible. With millions of users having deep conversations and often accepting AI at its word, this 4o situation just unearthed a very slippery slope for model development.

>Neuroscientists discover the chemical dopamine released along a specific brain circuit helps extinguish the sense of fear following an acute stressor; research may lead to new therapies for PTSD(More)

>Brain study reveals human consciousness may depend more on sensory input than previously believed and challenges two leading theories on its origin in the mind; result of seven-year study may inform treatments for incapacitated patients (More)

>Researchers achieve strongest-ever coupling between a qubit and a light particle; advance may allow the readout of information from quantum computers in a few nanoseconds (More)

Market view

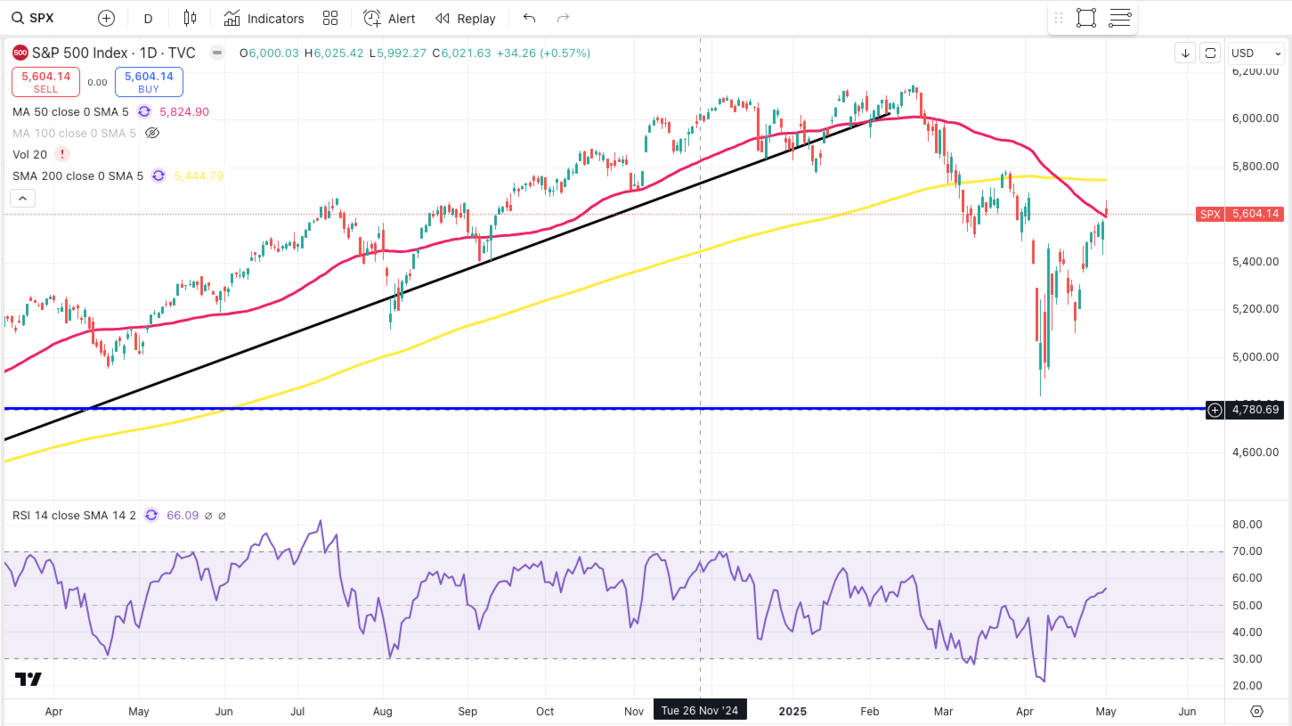

S&P 500

The rebound is very clean, despite leaving some gaps behind. The 50-period Moving Average at the 5600 level represents a strong support area and serves as an ideal springboard to avoid the formation of a lower high, which would otherwise confirm the continuation of the downtrend.

Potential market impact: Close attention is being paid to a possible decoupling between equities and the crypto market. Should economic conditions in the United States deteriorate without a corresponding decline in Bitcoin's price or a drop in ETF inflows, it could mark a pivotal moment for the continuation of the bull market.

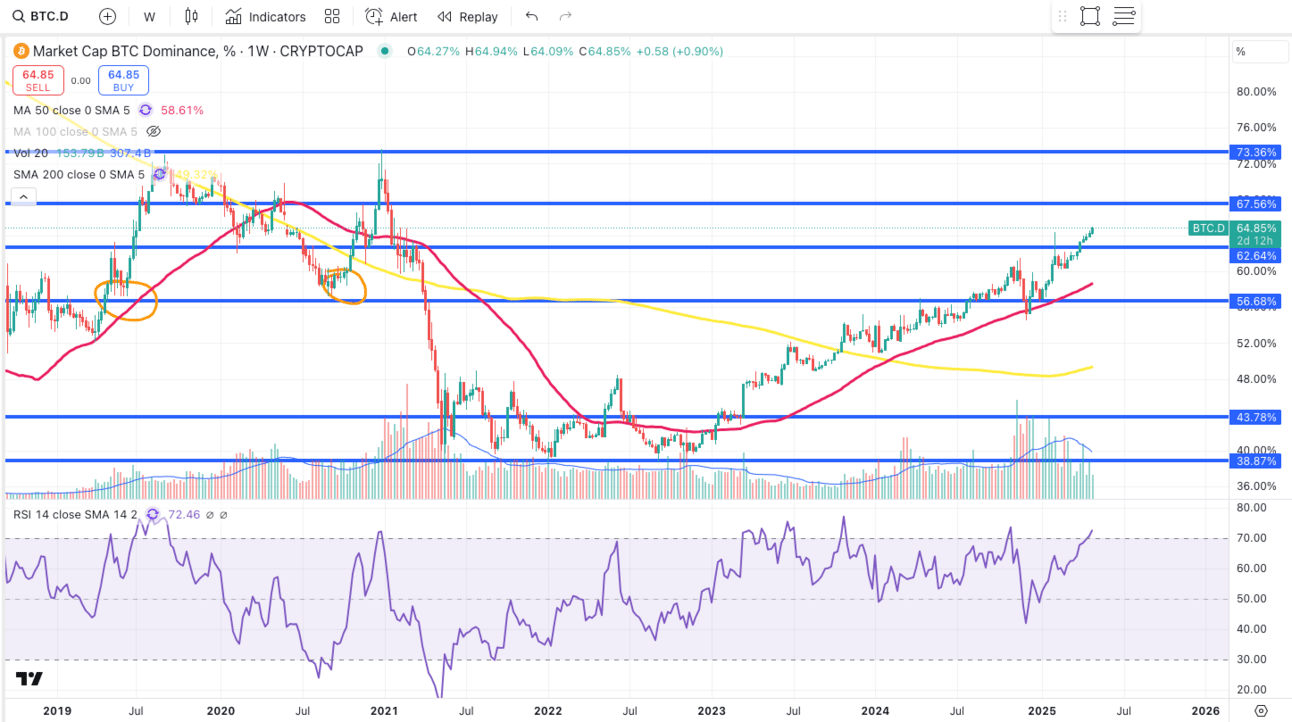

BTC.D

A weekly overbought RSI on Bitcoin Dominance is a relatively uncommon occurrence. Although the indicator holds limited significance due to its non-tradable nature, it can still serve as a useful reference point.

Potential market impact: Provided that no major negative events occur at the macroeconomic level over the coming weeks, I anticipate that altcoins will begin to regain some ground before Bitcoin dominance reaches the critical threshold of 67–68%.

At present, Bitcoin dominance has posted nine consecutive weeks of gains — the longest upward streak observed during this bull market.

Such a pattern is characteristic of the period preceding an altseason.

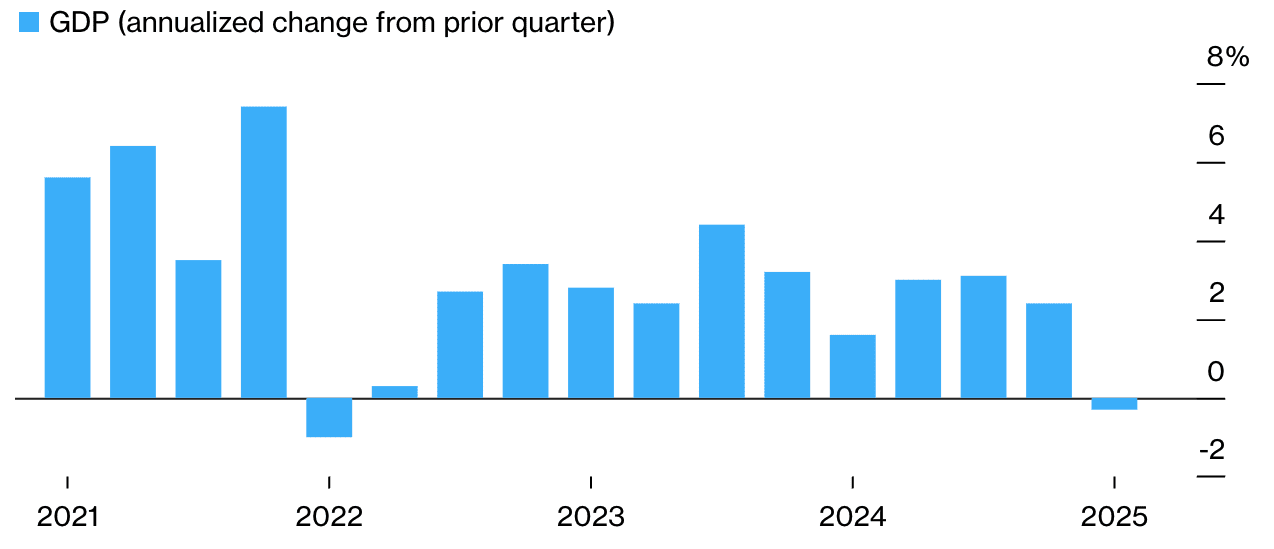

Growth remains well below the average of the past two years, which was around 3%.

Trump came out and said that the Q1 data isn’t really his responsibility, arguing fairly that it reflects Biden’s policies, since he only took office in January.

Consumer spending came in at 1.8%, marking the weakest report in the past two years.

Meanwhile, imports surged by 41.3% — a massive number, the highest in over five years.

This suggests that businesses were preparing for Trump’s tariffs, a factor that undoubtedly impacted the GDP figures as well.

What do all these numbers mean?

They give Trump more ammunition in his battle with Powell: a decline in GDP should typically lead to lower inflation — unless, we enter a stagflation phase.

That would mean sluggish economic growth combined with rising inflation.

Such a scenario would prevent the Fed from cutting interest rates, a crucial step needed to support the economy.

For now, the US Core PCE (which excludes the more volatile food and energy categories) came in at 2.6%, slightly above the 2.5% consensus.

We are rapidly approaching a make-or-break moment — a reality also reflected in the FedWatch Tool’s odds for a rate cut at the June 18 meeting.

2Y Yield — 3.75%, declining. It's below the 50-day moving average and very close to the 200-day moving average, which is at 3.5%. Since January 2022, the price hasn't fallen below the 200-day moving average.

Sentiment for risk assets: neutral.

10Y Yield — 4.26%, stagnant. Sitting right on the 50-day moving average at 4.27%.

Sentiment for risk assets: neutral.

There is a large gap between 10-year bonds and the dollar. One of them will have to make the first move toward "reconciliation.

For Trump — and for us — a DXY below 100 and declining 10-year bond yields would be preferable.