IN A WORLD THAT’S CHANGING SO QUICKLY THE BIGGEST RISK YOU CAN TAKE IS NOT TAKING ANY RISK.

In today's weekly journal

China raises retaliatory tariff on American goods to 125% from 84%

Open AI gives ChatGPT a memory boost

Revival of the Dire Wolves

Six Jumbo Jets Of iPhones

Record-Breaking $1 Trillion Defense Budget: Trump, Hegseth Say It's Happening

Market view by Benjamin Cowen

China raises retaliatory tariff on American goods to 125% from 84%

The new tariff is set to go into effect today and comes after the US raised its cumulative tariff on Chinese imports to 145%. The world’s two biggest economies haven’t signaled any immediate plans for trade negotiations. China is expected to file another lawsuit with the World Trade Organization against the US tariffs. Trade between China and US reached $583B last year, with a $295B US deficit. See an explainer on how tariffs could impact the US and global economy here .

Open AI gives ChatGPT a memory boost

OpenAI just rolled out a massive update to ChatGPT’s memory, enabling the AI assistant to automatically remember and reference information across all user conversations, delivering more personalized and relevant responses.

ChatGPT will cut across all conversations, listening in all the time and capturing users’ preferences, interests, needs, and even things they don’t like.

With all this information, the assistant will then tailor its responses to each user, engaging in conversations “that feel noticeably more relevant and useful.”

Unlike previous versions where users had to spesifically request that information be remembered, the system now does this automatically.

If you want to change what ChatGPT knows about you, simply ask in chat throush a prompt.

This feature is a game changer for active users who hate switching between chats or constantly repeating themselves. ChatGPT’s extended memory is a start to an exciting future where AI systems genuinely get to know you over time, becoming increasingly personalized and useful.

Users can opt out of the memory feature via ChatGPT’s settings or use temporary chat mode for conversations they don’t want remembered.

Revival of the Dire Wolves

Biotechnology startup Colossal announced yesterday it has successfully revived the dire wolf, which went extinct thousands of years ago and was popularized through George RR martin’s “Game of Thrones.” The breakthrough marks the world’s first de-extinction of an animal.

The dire wolf roamed the Americas more than 12,000 years ago before its prey-large herbivores like bison-were largely depleted. Colossal created three wolves: six-month-old adolescents Romulus and Remus, and a pup Khaleesi (see video here). The company created the wolves using DNA fragments from a 13,000-year-old tooth fossil and a 72,000-year-old skull. They also used CRISPR technology to edit genes of the dire wolf’s closest living relative, the gray wolf, selecting for white fur. How CRISPR lets you edit DNA .

Colossal-launched in 2021 and valued at $10B-seeks to recreate extinct species like the wolly mammoth and the dodo bird. The company hopes the projects will yield profitable insights to benefit human health, like helping to develop artificial wombs.

Six Jumbo Jets Of iPhones From India Part Of Apple's Scramble To Beat Tariff Blitz

Reuters provided more details on a strategic airlift operation that allowed Apple to sidestep tariffs that could have pushed iPhone retail prices above $2,300 per unit. By ramping up chartered air freighter flights, Apple transported approximately 600 tons of iPhones—equivalent to an estimated 1.5 million units—from India to the United States to beat President Trump's "Liberation Day" tariff blitz.

Sources said Apple chartered six jumbo jets, each with a capacity of 100 tons of iPhones, in recent weeks. There was no confirmation from sources on whether the aircraft used were Boeing 747-8Fs (maximum payload 140 tons) or Boeing 777Fs (maximum payload 102 tons). The planes reportedly departed from Chennai Airport in the southern state of Tamil Nadu. Inspection times were reduced from 30 to just six hours, underscoring the urgency by CEO Tim Cook to transport iPhones to the US before tariff deadlines.

Record-Breaking $1 Trillion Defense Budget: Trump, Hegseth Say It's Happening

With much of the globe and American public focused exclusively on tariff mania, President Trump as well as Secretary of Defense Pete Hegseth unveiled massive news on Monday, which would have normally made a bigger impact in headlines.

The Pentagon will soon have its first $1 trillion budget. President Trump said while hosting Israeli Prime Minister Benjamin Netanyahu at the White House, "Nobody’s seen anything like it. We have to build out military, and we’re very cost-conscious, but the military is something we have to build, and we have to be strong."

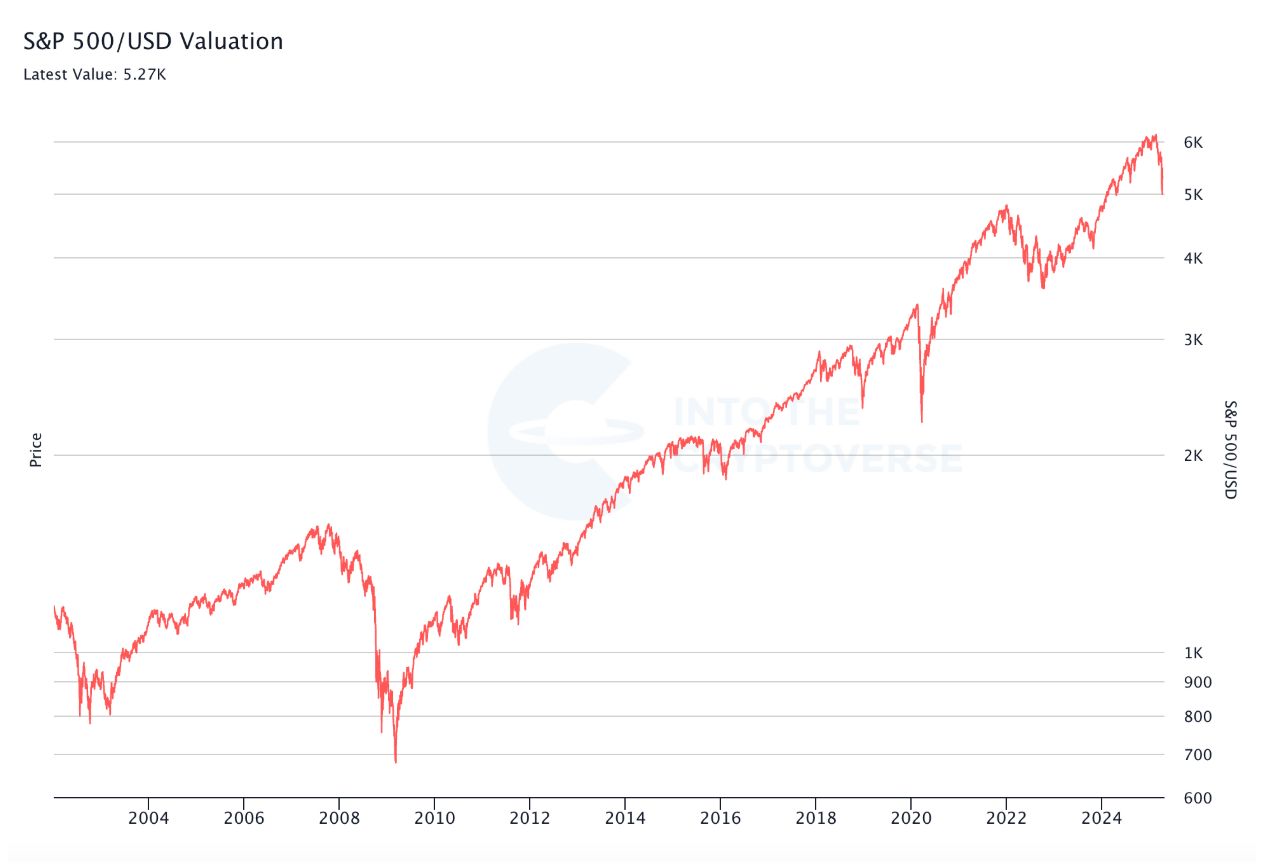

Market view by Benjamin Cowen

The recent 90-day on tariff exscalations has triggered a significant market recovery. After dropping approximately 20% from recent highs, the S&P 500 experienced a substantial 10% rally following this news. The tariff modifications include reducing rates to 10% for many countries during this 90-day period, though tariffs on China remain elevated.

This market bounce was somewhat predictable for several reasons:

1. The S&P 500 had declined by about 20%, which historically can mark a potential bottom even in recessionary environments

2. The index had swept below the previous years’s low, often a technical signal for a bounce

3. The market was searching for a catalyst, which arrived in the form of Trump’s tariff announcement

Looking at similar historical patterns, particularly from 1998, suggests several possible scenarios:

This could be a complete market bottom if we’re experiencing just a standard 20% correction

It could be part of a larger pattern where markets rally, then retest or slightly break below the recent lows before establishing a more sustainable recovery

The S&P 500 divided by M2 money supply chart shows the recent low corresponds to significant historical support levels

The rally’s sustainability remains uncertain. Markets often experience “whipsawing” as they chase different narratives. While this 10% upward move is positive for investors who were dollar-cost averaging during the decline, history suggests caution - large rapid recoveries don’t guarantee the end of volatility.

Several important economic indicators bear watching;

The 2-year Treasury yield has tested its low multiple times, suggesting it may eventually break lower, which could signal economic weakness

The 10-year Treasury yield temporarily returned to levels seen before the market decline, showing persistent inflation concerns

The relationship between the S&P 500 and unemployment figures may provide support levels for the market

Several factors will influence market direction in coming weeks:

China’s response to continued higher tariffs on their goods

Whether deals can be reached with various countries before the 90-day pause expires in July

Potential for a “Trump put” (similar to the concept of a “Fed put:) where presidential intervention occurs at specific market decline levels

The possibility of a pullback to a higher low in the next few weeks, which would be a normal pattern following such a large rally

Bitcoin has maintained support above the 2024 high, which is positive for market structure. However, a drop below $69,000 would be concerning for the bullish case.

The ongoing tariff uncertainty creates difficulties for businesses attempting to plan future operations and investments, which could impact hiring decisions and contribute to economic instability if not resolved.

the current market situations appears to rhyme with historical patterns. Technical indicators and economic data releases will likely determine market direction.

Podcast of the week: