Tracking the Forces That Move the World

Today's topic

THE MACRO

Iran-Israel conflict rises

Iran fired more than 100 drones and ballistic missiles in a counterattack against Israel yesterday, prompting air raid sirens and emergency measures in Jerusalem and nearby areas. The retaliation came after Israel deployed over 200 aircraft and dropped over 330 munitions on roughly 100 military officers. the attack appeared to be the biggest faced by Iran since its war with Iraq in the 1980s. See live updates here.

Israel says its operation aims to halt Iran’s progress toward developing nuclear weapons. Iran has enriched its uranium stockpile to nearly 60% purity, short of the 90% purity needed for weapons but well above the 3.67% used for civilian purposes like power, medicine, or research. President Donald Trump, whose administration has been holding talks with Iranian officials, has urged Iran to sign a deal to curb its nuclear program. Meanwhile, the US military reportedly helped Israel intercept Iran’s airstrikes

Black box recovered from site of fatal Air India plane crash

Indian officials hope the device, which records flight data, will help determine why the London-bound Boeing 787-8 Dreamliner crashed into a residential areas less than a minute after takeoff Thursday afternoon local time. Of the 242 souls on board, only one-a 40-year-old British man in seat 11A —survived. The number of ground casualties is at least eight as of this writing, as officials use DNA from family members to identify victims.

Science & Technology

At GTC Paris 2025, NVIDIA rolled out a major expansion of its robotics and AI infrastructure, debuting new platforms, open-source tools, and a 10K-GPU mega facility in Germany designed to power the continent’s next wave of intelligent machines.

Core details:

Isaac GR00T N1.5, a new foundation model for humanoid reasoning, is now live on Hugging Face, giving developers a flexible, downloadable brain for general-purpose robotics.

Isaac Sim 5.0 and Isaac Lab 2.2, updated simulation and learning environments, are optimized for RTX PRO 6000 system and available on GitHub for broader community access.

Halos, NVIDIA’s safety platform, now extends to robotics — adding real-time monitoring and fail-safe system via IGX platform and built-in AI agents.

NVIDIA confirmed a new German facility housing 10K GPUs — including DGX B200s and RTX PRO servers — designed to help manufacturers simulate, optimize, and scale robotic operations in smart factories.

Why it matters: This marks a serious investment in Europe’s AI edge, with NVIDIA announcing a raft of new regional partnerships spanning infrastructure, research, and industry. Robotics leaders like Agile Robots are already building with NVIDIA’s stack — positioning the company not just as a chipmaker, but as the platform layer for Europe’s AI future.

Norwegian robotics startup 1X has introduced Redwood, a groundbreaking reinforcement learning controller designed to make its home robot, NEO, capable of moving, perceiving, and acting with human-like fluidity in everyday environments.

Core details:

Multimodal Control in One System: Redwood combines language understanding, locomotion, and whole-body manipulation, enabling NEO to navigate, grasp, and interact seamlessly — without treating each skill as a separate problem.

Trained in the Real World: The model is based on extensive real-world data gathered from 1X’s EVE and NEO robots, including both teleoperated and autonomous sessions in household tasks.

Learning, from Mistakes: Redwood refines behavior based on both successes and failures, allowing NEO to retry actions, use both hands when needed, and handle unfamiliar objects on the fly.

Privacy by Design: All processing runs locally on NEO’s onboard GPU, ensuring low-latency performance without the need for cloud connectivity — a key feature for privacy-conscious homes.

Why it matters : Traditional robotics systems typically compartmentalize movement and manipulation, but Redwood’s end-to-end learning approach allows NEO to interact in spaces built for humans with unprecedented agility. Early home trials are already showing promising results, with 1X targeting 100.000 units by 2027 and scaling to millions by 2028 — a potential turning point in bringing humanoid robots into everyday life.

OpenAI is resisting a controversial court mandate tied to its legal dispute with The New York Times, which requires the company to preserve all user chat history, including messages users have manually deleted.

Core details:

Scope of the Order: The directive affects hundred of millions of users across ChatGPT’s Free, Plus, Pro, and Team tiers. Even chats users intentionally erased must now be retained.

NYT’s Argument: The Times pushed for preservation, citing concerns that users may be copying or infringing on its content — and then deleting the evidence.

CEO Response: OpenAI CEO Sam Altman condemned the order as an “inappropriate request that sets a bad precedent,” and called for protections akin to “AI privilege,” drawing comparison to doctor-patient confidentiality.

Exemptions: ChatGPT Enterprise, Edu, and API customers with Zero Data Retention agreements remain excluded from the mandate.

Why it matters: The ruling lands at a precarious time for trust in AI. As millions increasingly rely on tools like ChatGPT to process private thoughts, sensitive questions, and daily decisions, the notion of permanent data retention — even for deleted conversations — risks a major breach of user trust. With AI now moving into always-on physical devices, the privacy debate is set to intensify.

In a landmark public-private collaboration, the UK Government and Google have unveiled Extract, a new AI-powered tool designed to modernize the country’s outdated planning system. Built on Gemini’s multimodal capabilities, Extract aims to digitize and analyze vast volumes of planning documents — significantly accelerating housing and infrastructure approvals.

Core details:

Gemini-Powered Processing: Extract leverages Google’s Gemini AI to interpret complex, multimodal planning materials — including scanned documents, handwritten notes and low-quality maps — converting them into searchable, digital formats.

Efficiency Gains: According to officials, tasks that typically require up to two hours of manual work by a planning officer can now be completed in just 40 seconds, enabling radical efficiency improvements.

Live Trials Underway: The Extract system is curently being trialed across multiple UK councils, with early result indicating meaningful process acceleration.

National Rollout by 2026: A full-scale deployment is planned for Spring 2026, aligning with the UK’s goal to deliver 1.5 million new homes, a key national housing target.

Freeing Up Human Talent: The government emphasized that Extract is not intended to replace planners, but to eliminate repetitive and administrative burdens, allowing skilled professional to focus on decision-making, oversight, and community engagement.

Public Sector Transformation: Extract serves as a model for how AI can transform core government workflows, particularly in sectors constrained by legacy systems and paper-heavy records.

Why it matters: As global governments face growing pressure to deliver infrastructure faster, AI’s most immediate impact may not come from futuristic application — but from modernizing slow, manual processes. Extract represents a compelling case study in pragmatic AI deployment: less about disruption, more about unlocking speed, clarity, and scale in public service delivery.

Amidst concerns about academic integrity, major Chinese technology firms temporarily disabled or limited access to AI functionalities on their platforms during the recent national university entrance exams, known as the gaokao. This action was taken to prevent students from potentially using AI tools to cheat on the high-stakes tests. Platforms like Doubao and kimi refused to process exam-related request or analyze relevant images, informing users of the service suspension for the duration of the testing period. This measure highlights the challenges AI presents to traditional educational assessments, alongside other anti-cheating efforts employed by authorities, suggesting a significant restructuring of education is deeded to adapt to the AI era.

Why it matters: AI is causing chaos throughout the education system, with pre-ChatGPT testing methods and assignments proving no match for today’s models — and educators having few ways to stop it. Schooliing is in for a complete overhaul in the AI era, with some major bumps in the road along the way.

>Missing link in tyrannosaur evolution potentially found in Mongolian museum; 86-million-year-old “Dragon Prince” fossils are believed to be the closest ancestor to tyrannosaurus rex(More)

>Scientists develop stretchable brain implant that allows the study of neurological development in animal embryos at the earliest stage of life (More)

>Scientists map neurons in the brain affected by alcohol consumption, identify brain circuit involved in binge drinking; may lead to new therapies to treat alcohol abuse(More)

Market view

BOND SENTIMENT

2Y Yield - 3.95%, still trading between the 50 and 200 moving averages. Sentiment for risk assets: neutral.

10Y Yield -4.4%, stagnating. Sentiment for risk assets: neutral.

If 10-year bond yields decline, that’s a positive sign — especially if rates stay below 4.50%.

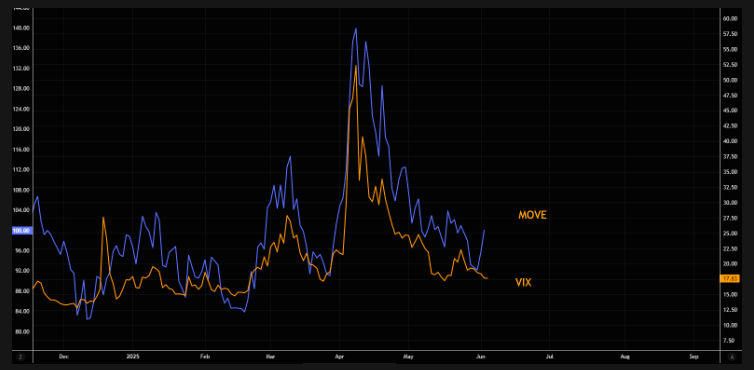

A more illustrative example is the correlation between the MOVE index, which tracks bond market volatility, and the VIX, which measures stock market volatility.

STOCKS

The S&P 500 and Nasdaq Composite index in red for most of the session, closing 1.2% and 1.3% lower, after the S&P 500 has surged more than 20% over the last 40 sessions — marking the third-strongest 40-session rally since the year 2000.

The same holds true for the Nasdaq, which has climbed 27.5% over the same 40-trading-day span.

Bitcoin

After making a run approaching its all-time high last week, bitcoin was back in the red, hovering around 105,000. Bitcoin’s late-May rally coincided with a surge in short liquidations. In other words, investors were buying up BTC to cover their leveraged short positions.

That being said, BTC often trades like a Big Tech stock: It’s high volatility and, at least in recent months, has not been insulated from macroeconomic moves.

Bitcoin’s correlation to the Nasdaq composite is currently 0.81, according to data from Yahoo Finance. The crypto’s correlation with gold has recently moved negative, now sitting at -o.07 , per Yahoo Finance.

Looking ahead, the eight biggest US tech stocks (Mag 7 plus Broadcom) have seen an average downward earnings revision for Q2 of -5.9% (-2.2% if you exclude Tesla). Half of these names are currently underperforming the S&P year to date (Tesla, Apple, Alphabet and Amazon).

Inflation outlook

CPI rose 0.1% over the month and 2.4% annually. Economists had projected the figures to com in at 0.2% and 2.4%, respectively.

Core CPI which excludes volatile food and energy prices, also rose 0.1% over the month and 2.8% year over year, compared with expectations of 0.3% and 2.9%, respectively.

June’s data will more accurately reflect how the United States latest deal with China is impacting exports, assuming this new truce is inked and lasts.

June’s big FOMC meeting

Next week is FOMC Day, and it feels like it’s going a highly contentious one.

One one hand, you have President Trump pressing Chair Jerome Powell to cut rates as soon as possible:

On the other hand, you have the FOMC towing the line that they’re in a “wait-and-see” mode. This is because they don’t want to react in either a dovish or hawkish direction until they have a better idea of where the tariff policy will net out.

Currently, there’s a 99.6% implied probability for Fed to pause.

However, next week will also have a dot plot meeting wherein we’ll receive an update on the Fed’s summary of economic projections (SEP). If the Fed wanted to signal a dovish tilt, the SEP is what will be used to signal that.

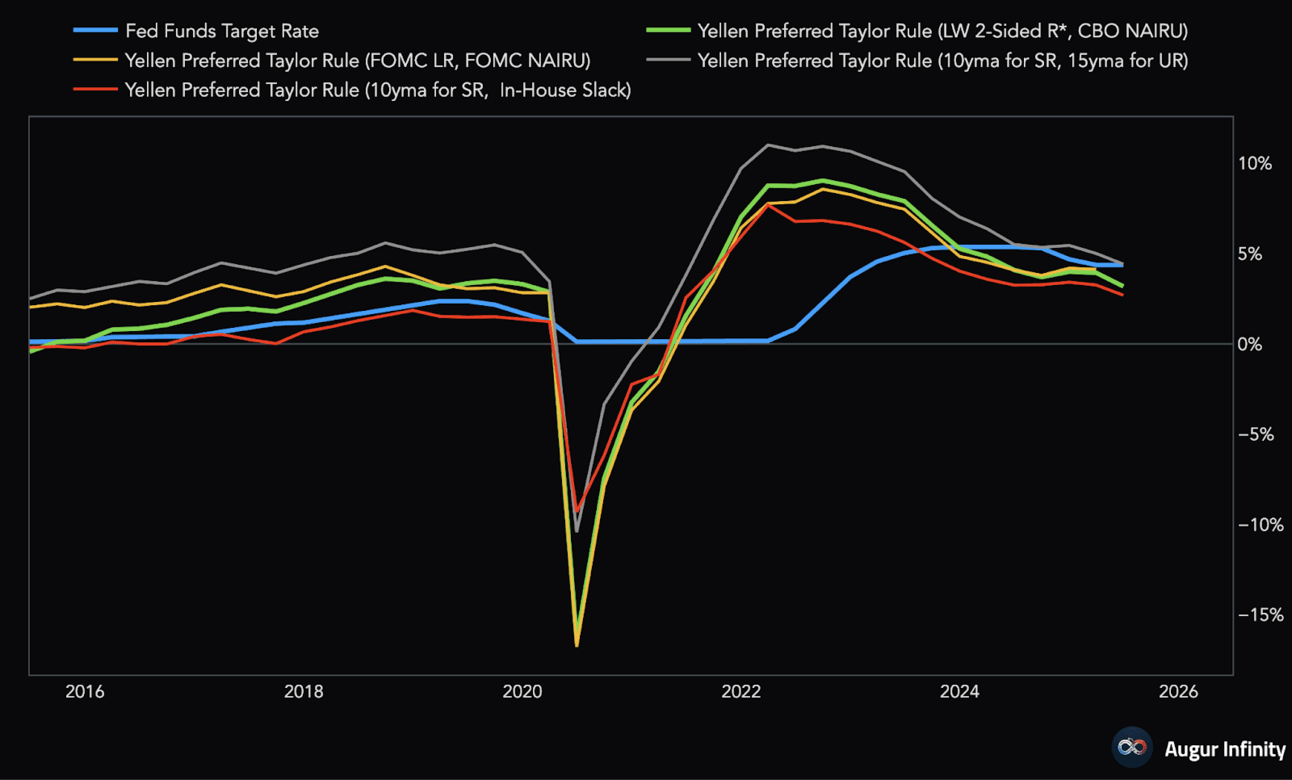

To assess if that will happen, let’s review the latest economic data influencing the FOMC’s decisions next week. The fed has emphasized being data-driven while managing inflation above its 2% target for years. According to the Taylor Rule — a reliable model measuring monetary policy tightness based on the Fed’s goals of maximum employment and stable prices-the Fed should currently be cutting rates, but it isn’t.

Labor

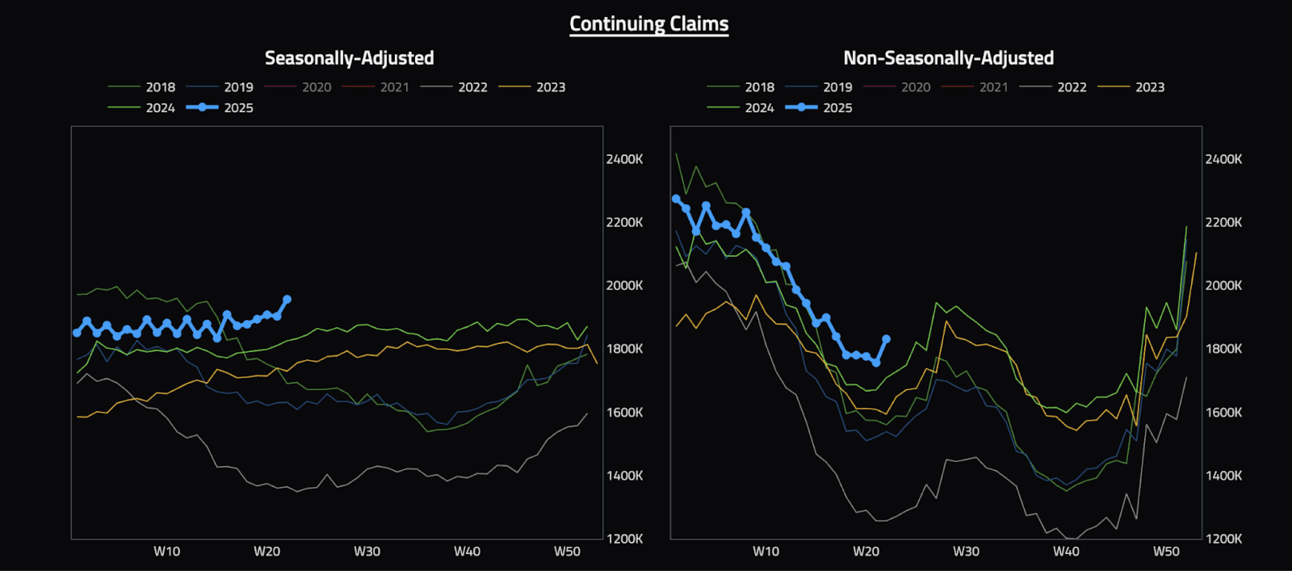

This week we saw a huge uptick in continuing jobless claims, emphasizing just how hard it is to get a job when you lose one.

While we haven’s seen a sharp rise in unemployment or initial jobless claims, this increase confirms that hiring remains very slow. However, layoffs haven’s started either-we’re currently is a phase of attrition.

This is a delicate situation. By the time the labor market worsens enough to cause a spike in unemployment and job losses, the Fed will be far behind according to the Taylor Rule model discussed earlier.