IN A WORLD THAT’S CHANGING SO QUICKLY THE BIGGEST RISK YOU CAN TAKE IS NOT TAKING ANY RISK. Peter Thiel

In today’s weekly journal

Science & Technology

Amazon just hit a major automation milestone: it has deployed its 1 millionth warehouse robot. At the same time, it also unveiled a new proprietary generative AI model designed to work with humans in warehouse environment — a major step in fusing physical robotics with AI smarts.

Core details:

Amazon has been steadily automating for over a decade, starting with its acquisition of Kiva Systems in 2012.

The company’s robot fleet now includes a variety of systems like Proteus (mobile carts), Sparrow (robotic arms), and Sequoia (storage/retrieval bots).

The new generative AI model is trained on Amazon-specific tasks — aimed at making robots more adaptable, improving safety, and enhancing coordination with human workers.

It can understand warehouse layouts, predict task bottlenecks, and generate solutions for real-time operations.

Amazon says this hybrid approach will improve efficiency while “augmenting,” not replacing, human roles.

Why it matters: Amazon’s twin announcements highlight how automation and AI are converging in real-world environments. Reaching one million robots signals the scale of industrial automation, while the introduction of a generative AI model shows Amazon’s intent to make robots smarter and more autonomous. For the future of logistics, this could mean faster delivery, fewer human errors, and more data-driven warehouse systems — though it also raise ongoing questions about labor, displacement, and the balance between man and machine.

China just held its first fully autonomous humanoid robot soccer tournament, with AI-powered robots playing 3-on-3 matches—no human control, just onboard smarts.

Core details:

Four university teams competed in Beijing using T1 robots from Booster Robotics, equipped with cameras and sensors to track the ball, field and opponents.

The bots ran, dribbled, passed, and shot—sometimes celebrating with fist pumps, sometimes falling flat or limping off on stretchers.

Each game had two 10-minute halves, testing the bots’ real-time decision-making under pressure.

In the final, Tsinghua University beat China Agricultural University 5—3.

Organizers called it a “testing ground” for human-robot interaction, eyeing future matchups between humans and robots—though safety is still a hurdle.

Why It Matters: This isn’t just a tech flex—it’s a glimpse at where AI, robotics, and sport might converge. Real-world athletic performance under dynamic conditions is next-level training for autonomous system. And yes, robot soccer might one day be more than a sideshow.

Researcher in China and Hong Kong have developed light-sensitive, magnetically guided microrobots to treat stubborn sinus infection—without surgery or antibiotics.

Core details:

The microrobots (called CBMRs) are made of copper-doped bismuth oxyiodide and are injected into the sinuses via catheter.

A magnetic field steers them to infection sites, while a fiber optic light source activates them for multi-mode attack:

Photothermal heating loosens thick mucus

Collective mechanical force breaks apart bacterial biofilms

Reactive oxygen species (ROS) are released to kill bacteria

In animal models (rabbits and pig sinus tissue), the robots fully cleared infection without damaging healthy tissue.

After treatment, the bots can be safely expelled by blowing the nose.

The study, published in Science Robotics, was led by CUHK and mainland China researcher.

Why It Matters: This tech offers a precise, non-invasive alternative to antibiotics and surgery for stubborn sinus infection. It reduce the risk of antibiotic resistance and could be adapted for treating other deep-tissue infection in the future. While challenges remain, it signals a major leap in targeted, drug-free therapies.

Google has signed a 200MW power purchase agreement with Commonwealth Fusion System (CFS), marking the largest direct corporate offtake of fusion energy to date. The clean energy will come from CFS’s planned ARC fusion power plant in Virginia, slated for grid connection in the early 2030s.

Core details:

The deal covers half of ARC’s projected 400MW output, with Google also increasing its equity stake and securing rights power from future plamts.

CFS, an MIT spin-off backed by over $2 billion in funding, is currently building the SPARC demonstration tokamak in Massachusetts, aiming to achieve net energy gain by 2027.

The ARC plant near Richmond will leverage high-temperature superconducting magnets in a compact tokamak to deliver clean, continuous energy in the 2030s.

As part of its broader sustainability efforts, Google has long-term agreements covering 22 GW of clean energy from solar, wind, nuclear, and geothermal—but fusion is its boldest long-term investment.

Why It Matters: This deal signal a pivotal shift in clean energy strategy: Google is betting early on fusion—a technology that promises an abundant, carbon-free, and virtually waste-free power source. Though fusion’s commercial arrival remains years away, this move highlights growing confidence that it can meet the escalating energy demands driven by AI and data centers. Google’s commitment not only strenghtenes CFS’s path to commercialization but also sets a new benchmark for corporate support in scaling fusion power globally.

China is accelerating its investment and experimentation in brain-computer interfaces (BCIs), with new trials aiming to help with paralysis regain control through wireless implants, smart devices, and even speech decoding in Mandarin. While less advanced than some U.S. systems like Neuralink, China’s BCIs are rapidly evolving — and gaining real-world traction.

Core details:

StairMed’s deep-brain BCI, currently in human trials, allows a man with no limbs to play computer games using 64 ultra-thin probes. The device is smaller and less invasive than Neuralink’s, and wirelessly transmits data .

The NEO system, implanted in 20 patients so far, uses eight surface-level probes to help users regain hand control via a pneumatic glove. While less precise than deeper implants, it is minimally invasive and long-lasting.

One version os the NEO system uses neuromorphic chips, mimicking the brain to process signals more efficiently, allowing for smaller, faster, and less power-hungry devices.

NeuroXess, a Shanghai-based BCI company, implanted 256 probes in a woman’s cortex, allowing her to control apps and wheelchair. Another participant used a BCI to communicate in Mandarin at 50 words per minute — a real-time decoding milestone.

The Chinese government has designated BCI as a national innovation priority, pouring funding into the field and leveraging the country’s large medical infrastructure an tech ecosystem for rapid development.

Why it matters: While China may trail in BCI legacy and complexity compared to U.S. firms like Neuralink, its scale, speed, and state backing give it an edge in bringing functional, accessible brain-computer technologies to market. The combination of lower invasiveness, neuromorphic processing, and real-world trials positions China to be a major player in neurotechnology — especially in integrating BCIs with AI, robotics, and language interfaces like Mandarin. The world may soon see brain tech go mainstream faster than expected — with China helping lead the way.

🔬Science snapshot

🧠New imaging analysis reveals how quickly the human brain is aging from a single MRI scan; tool can assess risk of dementia and chronic disease, motivate lifestyle changes to improve brain health(More)

🧬Genetic ancestry linked to risk of contracting severe cases of dengue fever; findings partially explain the wide variability in cases, disease kills around 20,000 people annually(More)

🧪Researcher discover switching on a single dormant gene enables mice to regrow ear tissue; discovery may lead to treatments for a variety of degenerative disease(More)

💡These advances show how genomics, imaging, and cellular reprogramming are rewriting our understanding of the body’s limits.

Market view

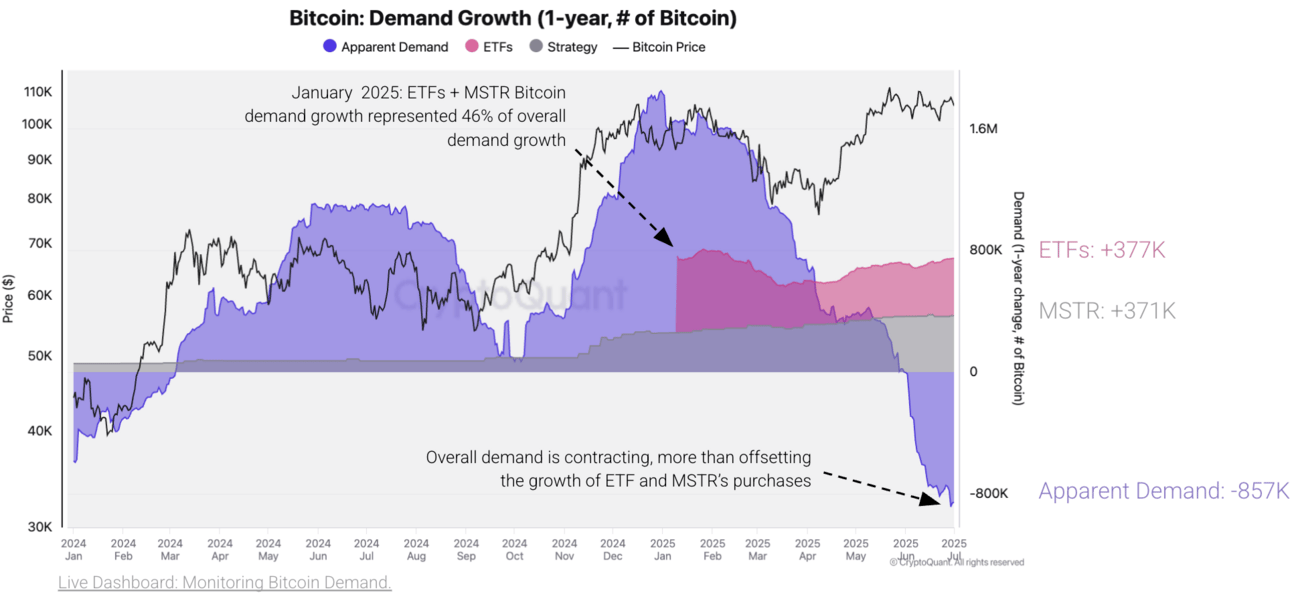

Why Bitcoin isn’t surging despite ETF buying

Even with steady Bitcoin accumulation from ETFs and corporate players like MicroStrategy (MSTR), prices remain stuck below all-time highs.

Why?

Net demand is weakening.

While ETFs and MSTR are buying, their impact is shrinking. At peak in Dec 2024, they drove 33% of total demand growth — today, they’re offset by a broader 895K BTC drop in overall spot demand.

Institutional buying is slowing.

ETF purchases fell 53% since December

MSTR purchases dropped 90%, from 171K BTC to just 16K BTC over 30 days

Institutional interest remains, but it’s no longer enough to push Bitcoin to new highs. Broader demand must rebound to break the current price consolidation.

Conversely, a low exchange reserve indicates diminished selling pressure. In such instance, a smaller number of coins are held within centralized exchanges, awaiting potential trade transactions. This suggest that market participants are more inclined to withdraw their coins from the exchange for purposes other than immediate selling, leading to reduced supply available for trading.

o a reduced supply available for trading.

Ethereum ETF holdings trend: Institutional accumulation resume

This chart tracks the aggregate Ethereum holdings of non-ETHE, non-spot ETH ETFs — including ETHA, FETH, EZET, ETHW, and others — from August 2024 to July 2025

Following a sharp accumulation phase through Q1 2025, driven primarly by ETHA and FETH inflows, ETF-held ETH plateaued during Q2 as market sentiment cooled and flows normalized. Notably, a temporary contraction in holdings occurred during May-June, likely due to internal fund rebalancing or custodial lag effects.

As of early July 2025, holdings have resumed an aggressive upward trajectory, now exceeding 2.4M ETH, a new high for these ETFs. This uptick suggest renewed institutional positioning, potentially in anticipation of U.S. spot ETH ETF approvals or macro shifts in crypto allocations.

Despite occasional data discontinuities (visible as vertical drops), the macro trend remains structurally bullish for ETH exposure via regulated instruments.

The shifting landscape of stock market returns: Why picking winners just got harder

For decades, the go-to advice for retail investors has been simple: buy and hold a U.S. index fund. Historically, this strategy paid off — the S&P 500 has returned an average of about 8.5% annually since 1928, largely powered by compound interest and long-term market growth.

Butt beneath this rosy average lies a statistical reality most investors overlook: very few stocks actually drive those returns.

According to research by Hendrik Bessembinder, just 4% of stocks accounted for all net gains in U.S. equity markets between 1926 and 2019. In contrast, the remaining 96% of listed stocks — in aggregate — contributed nothing. in fact, more than half of all individual stocks failed to beat the returns of one-month Treasury bills, and the most common lifetime return for a stock was a total loss of 100%.

This pattern, known as positive skewness, means that a tiny fraction of “mega-winners” — like Amazon, Microsoft, or Nvidia — offset the mediocre or negative performance of the majority. And over long time horizons, compounding magnifies this effect.

The new challenge: Fewer winners in the Index

Today, the issue is getting worse. The companies most likely to become the next Microsoft or Amazon — think OpenAI, SpaceX, Epic Games — are staying private fal longer, backed by abundant venture capital and avoiding the regulatory demands of public markets.

That’s a problem for everyday investors who rely on public markets to grow retirement portfolios. If the most transformative companies remain private, index funds won’t capture their returns — making the historical 8.5% benchmark increasingly outdated.

The private market workaround

Enter Republic, a regulated U.S. investing platform aiming to bridge the gap. Using Blockchain, it plans to offer tokenized “mirror shares” — digital representation of private equity — that give retail investors synthetic exposure to companies like SpaceX and OpenAI. These tokens, tradable onchain between verified users, are designed to mirror the value of real shares without conveying actual ownership rights.

The idea has caught attention: Republic has already recieved over $300 million in pre-orders.

Buyer Beware: The risks are real

While the concept is innovative, these mirror shares come with significant caveats. They’re not true equity — they’re effectively tradeable IOUs, redeemable only if the company IPOs or is acquired. They’re issued by Republic, not the companies themselves, introducing counterparty risk.

And valuation is a concern. Companies like OpenAI are already valued at over $300 billion. By contrast, Microsoft IPO’d under a $1 billion valuation at a P/E ratio of 10. The explosive gains of the past were possible because investors got in early and cheap — conditions that no longer apply to most well-known private firms today.

Conclusion: Don’t count on 8.5%

As the number of public companies shrinks and the most dynamic firms avoid public markets, it’s getting harder to capture outsize returns through traditional investing. Platforms like Republic offer new tools — but they’re not magic bullets. They come with structural, legal, and valuation risks that are easy to underestimate.

The harsh reality? Just owning a broad market index may no longer be enough. Diversification still matters, but retail investors may need to rethink how — and where — they find the next generation of winners.

And whatever the approach, don’t count on 8.5% a year from a portfolio of high-priced private company tokens.

Video to watch : A.I., Mars and Immortality: Are We Dreaming Big Enough?

Have a great Sunday.