IN A WORLD THAT’S CHANGING SO QUICKLY THE BIGGEST RISK YOU CAN TAKE IS NOT TAKING ANY RISK. Peter Thiel

In today's weekly journal

Musk-Trump Clash

Iran’s Nuclear Program

Dutch Government Collapses

New Travel Ban

AI Beats humans on emotional intelligence tests

AI pioneer’s safety nonprofit for ‘honest’ AI

FDA approves AI tool to predict breast cancer risk

Market View

THE MACRO

Musk-Trump Clash

Elon Musk publicly broke with President Donald Trump. The rupture—largely chronicled in interviews, on Musk’s X platform, and on Trump’s Truth Social—ends a monthslong alliance between two of the world’s most powerful men. See updates here.

The clash comes one week after Musk left the Department of Government Efficiency, which boasts $180B in taxpayer savings(not all savings are itemized). Musk has since been critical of Trump’s signature tax bill, projected to add $2.4T to national debt through 2034. Musk floated creating a third political party yesterday. Trump threatened to cut government subsidies and contracts for Musk’s businesses, sending Tesla shares down as much as 14% in just one day . The two also exchanged personal attacks, with Musk suggesting links between Trump and late sex offender Jeffrey Epstein.

Iran’s Nuclear Program

The Trump administration confirmed it sent a nuclear deal proposal, the details of which were not publicly disclosed. The news comes after a UN watchdog report was leaked over the weekend, finding Iran had conducted secret uranium enrichment activities in three previously undisclosed facilities: Lavisan-Shian, Varamin, and Turquzabad.

The report also found Iran possesses 400 kilogram of uranium at 60% purity, significantly above levels for civilian purposes and enough for 10 nuclear weapons if enriched to 90% purity-a step estimated to take less than two weeks (a bomb would then take months to build). The international Atomic Energy Agency, which has monitored Iran since the early 2000s, did not find evidence Iran’s program has slowed sins restarting negotiations with the US in April. Instead, Iran’s stockpile has amassed the equivalent of one nuclear weapon per month for the past three months.

The US, the UK, France, and Germany are expected to refer the IAEA report to the UN Security Council. Israel has threatened to strike Iran’s nuclear facilities if US talks fail.

Dutch Government Collapses

The Dutch government collapsed after far-right populist leader Geert Wilders withdrew his Party for Freedom from the four-party coalition, ending the administration less than a year after it was formed. Wilders blamed the split on his partner’s refusal to back new immigration proposal that included suspending all asylum applications and tightening border controls.

Prime Minister Dick Schoof, an independent, said he would submit his resignation to the King while continuing in the caretaker role. Coalition leaders said they didn’t oppose Wilder’s plans outright but wanted to debate them in the House of Representatives—an approach that would have delayed any action and offered no guarantee of passage, though the coalition holds a majority with 88 out of 150 seats.

The collapse leaves the Netherlands under a caretaker government just weeks before a NATO summit June 24-25, where key defense decisions are expected. While the remaining coalition parties could try to continue in a different form, that’s seen as unlikely, and new elections are expected this fall.

New Travel Ban

President Donald Trump signed a travel ban, preventing nationals from 12 countries from entering the United States and partially restricting entry from seven others. The order, which cites national security risks, is scheduled to go into effect at 12:01 am ET Monday.

The ban follows a Jan. 20 executive order requiring the Department of Homeland Security and other agencies to assess national security risks and hostile attitudes toward the US from foreign countries. The White House says countries targeted by this ban have high visa overstay rates or fail to properly vet or share threat information on their citizens entering the US.

Countries whose foreign nationals will be banned are Afghanistan, Myanmar(Burma), Chad, Republic of the Congo, Equatorial Guinea, Eritrea, Haiti, Iran, Libya, Somalia, Sudan, and Yemen. Countries with partial restrictions include Burundi, Cuba, Laos, Sierra Leone, Togo, Turkmenistan, and Venezuela.

Science & Technology

AI beats humans on emotional intelligence tests

Researcher from the University of Geneva and the University of Bern found that ChatGPT and other AI systems beat humans on emotional intelligence tests, indicating AI may be better at reading emotions and responding than people.

Six AI models were tested on standard emotional intelligence assessments, tasked with selecting emotionally appropriate responses to complex scenarios.

GPT-$,o1,Gemini1.5 Flash, Copilot 365, Claude 3.5 Haiku, and deepSeek V3 scored an 81% average in testing, compared to 56% for human participants.

Beyond just test-taking, GPT-4 also proved capable of quickly creating entirely new and valid emotional intelligence assessments.

The researchers believe the results show AI’s grasp of emotional concepts and reasoning, not just pattern regurgitation from training data.

While AI can’t actually “feel” emotions like human do, its ability to mimic and display optimal emotional intelligence in difficult situations might be just as valuable — and shows the massive promise for integrating LLMs into fields like mental health support, customer service, and education.

AI pioneer’s safety nonprofit for “honest” AI

AI godfather and Turning Award winner Yoshua Bengio unveiled LawZero, a nonprofit dedicated to building “safe-by-design” Ai systems, also securing $30M in funding to develop “Scientist AI”, which prioritizes truth and transparency.

LawZero aims to create AI systems that provide probabilistic assessments rather than definitive answers, acknowledging uncertainty in their responses.

The organization”s “Scientist AI” hopes to speed scientific development, monitor other AI agents for deceptive behaviors, and address AI risks.

Initial backers include former Google CEO Eric Schmidt’s philanthropic arm, Skype co-founder Jaan Tallinn, and several AI safety organizations.

Bengio warns that current leading AI models, like o3 and Claude 4 Opus, show concerning traits including self-preservation instincts and strategic deception.

He also told that he doesn’t have confidence that OpenAI will adhere to its original mission, citing commercial pressures.

AI godfathers Bengio and Geoffrey Hinton have been outspoken critics of leading AI labs on the safety front, sounding the alarm with constant media appearances and open letters. But LawZero represents Bengio’s biggest step yet, taking AI safety into his own hands with an organization dedicated to the effort.

FDA approves AI tool to predict breast cancer risk

The U.S. Food & Drug Administration granted authorization for Clarity Breast, the first AI platform that can predict a woman’s breast cancer risk from routine mammogram images, enabling a commercial launch for the preventative tool this year.

The AI analyzes subtle patterns in mammogram images invisible to humans, generating five-year risk scores without family history or demographic data.

The platform works with standard 2D mammograms and was trained on millions of diverse images to avoid bias issues common in other risk models.

In testing, half of the younger women tested showed risk levels typically seen in much older patients — challenging standard age-based screening protocols.

Hospitals and imaging centers can start offering the service later this year, though patients will initially pay out-of-pocket until insurers get on board.

The first wave of AI medical tools is starting to make its way from the lab to actual consumers — and with powerful diagnostic and predictive capabilities, these tools may help shift medicine from its current reactive approach to a more proactive and preventative approach to healthcare.

>Genetic analysis reveals the bacteria responsible for leprosy existed in the Americas for at least 1,000 years, contradicting prevailing theory it was brought by European explorers(More)

>Black holes studies reveal gravitational waves of two intermediate black holes merging; current theories suggest the objects should be common, but only about 10 have been confirmed(More)

>Brain implant startup Paradromics completes its first human demonstration, inserting and removing the device into an epileptic patient; company is viewed as a potential competitor to Neuralink(More) Neuralink raises $650M, investment round includes Founders Fund and Sequoia Capital(More)

>Undergraduate student discovers fungs that produces compounds with effects to synthetic LSD (More)

Market view

Bond sentiment

2Y Yield -4.03%, currently trading between the 50- and 200-day moving averages. Sentiment toward risk asset: neutral.

10Y Yield - 4.50%, sentiment toward risk asset: neutral.

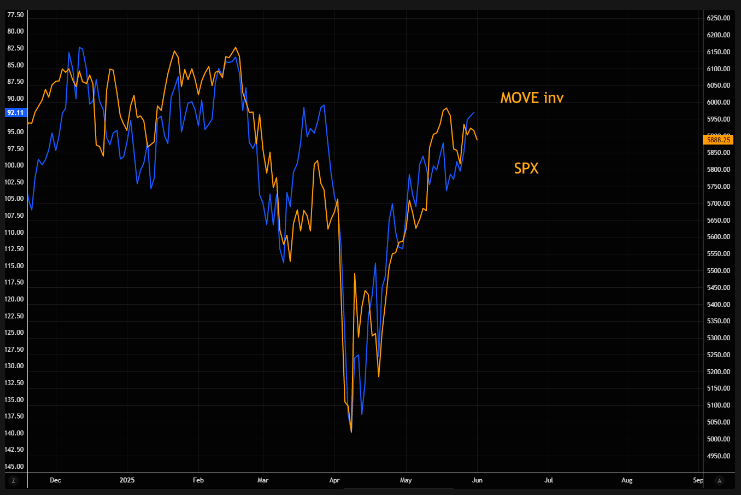

The Move index, which measures bond market volatility, suggests that when volatility is low, equities tend to climb — and crypto follows.

But there’s a more nuanced dynamic at play: it’s not just the level of interest rates ( be it the 2Y, 10Y, or 10Y yield) that matters. It’s the pace of chance — how fast rates are rising or falling — that sets the tone for uncertainty. A stable or slowly shifting yield environment tends to ease market anxiety, opening the door for risk assets to rally.

Since 2020, non-U.S. investors have purchased $350 billion worth of stocks and $200 billion in bonds.

jobs growth slows in May amid tariff uncertainty

US employers added 139,000 nonfarm jobs last month, higher than the 125,000 jobs economists had estimated but lower than the downwardly revised 147,000 jobs in April. The unemployment rate held steady at 4.2%. Average hourly earnings rose 0.4% month over month in May and 3.9% year over year; both figures surpassed expectations of 0.3% and 3.7%, respectively.

Sluggish spending

Not only is summer just around the corner, but a new month means new data around venture capital spending.

Fundraising totaled $594 million month, per Blockworks Research data.

As you can see, funding made up a very small slice of the overall pie, with M&A leading the month when it comes to money spent. A little over $2.9 billion went towards deals last month, of which most of that sum came from the $2.9 billion Coinbase-Deribit deal.

There were roughly 61 raise announcements, again slightly lower than what we’ve previously seen, as depicted in the chart below.

While momentum clearly slowed, it’s on par for the season. Taking a look at the activity from last May to now, it looks like both years have seen a dip.

Per the TIE Terminal, it looks like the average venture capital round announced last month was the seed stage, with strategic rounds coming in second.

Seed rounds tend to be smaller rounds, since they’re among the first rounds raised by projects so that could contribute to the overall sum. Strategic rounds can also be small, given that they’re generally a way for a start-up to not only access some capital but also support from investors.

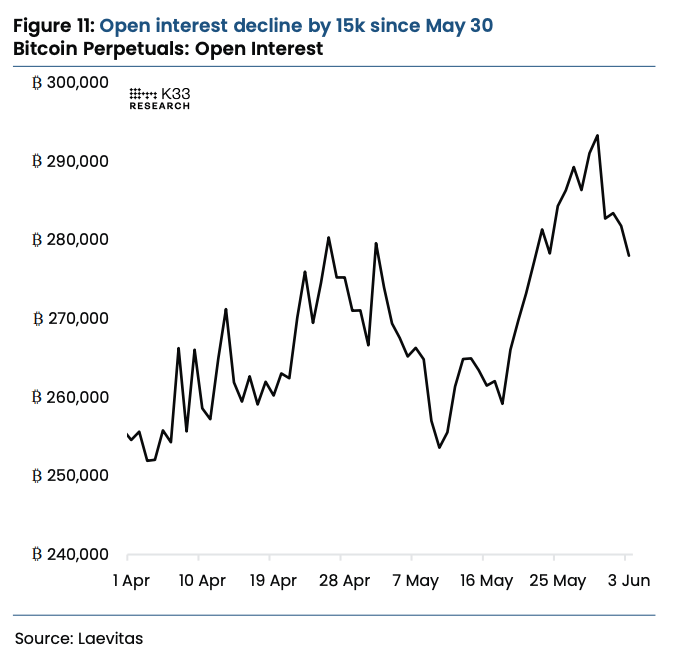

K33 analyst warns of potential volatility ahead

K33 noted that CME exposure has “risen modestly,” but it’s nowhere near its previous peaks.

As you can see in the chart above, open interest for CME bitcoin futures is in a slight downtrend.

The good (and potentially risky) news is that “offshore perpetual markets have seen growing open interest nearing late 2024 highs, but with ambiguous funding rates, setting the stage for heightened liquidation risks and potential volatility spikes in both directions.”

Overall, the derivatives environment has gotten a bit of a chill despite us heading into summer, with analyst Vetle Lunde noting that the perpetual future open interest dropped by 15,000 bitcoin since the end of May. The silver lining here, though, is that overall we’re seeing open interest remain near April highs at 278,000 BTC.

“While exposure from both direct participants and leveraged ETFs on CME has seen an uptrend over the past month, both cohorts see considerably lower exposure than during prior activity peaks. This is indicative of broad passivity and modest froth, despite BTC’s solid performance over recent months,” Lunde noted.

Podcast of the week: